Wall Street, California, was excited Friday after reports that x86 giant Intel Corp. was in talks to acquire FPGA maker Altera, which shook some analysts Monday morning.

Last Friday, the Wall Street Journal and Reuters reported that Intel is in talks to acquire Altera. The FPGA maker's stock price soared from $ 34.74 to $ 44.41 in thirty minutes, which will drive the price of Intel's largest acquisition ever from $ 10 billion to $ 13 billion. On Monday, Altera's stock price cooled slightly to about $ 42.

Rich Wawrzyniak, a senior analyst at Semico Research, said: "People have been talking about such things for two or three years, but when I lose Intel's advantage, I'm not sure I will come up with a long list."

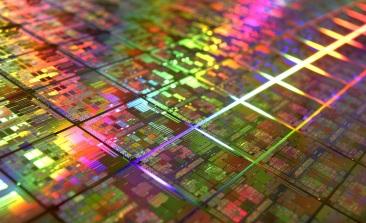

The deal will help Intel diversify beyond the declining PC market, expanding its growing business in areas such as telecommunications. Like Intel, Altera sells chips at relatively high average prices and profit margins.

However, compared to Intel's computer market, the FPGA market is small. Some people have questioned that this transaction would cost up to $ 13 billion to get a deal with less than $ 2 billion in annual revenue

Intel and Altera have had close ties in recent years and could trigger discussions about acquisitions. Altera will use Intel as a supplier to the 14nm foundry, although it still maintains long-term relationships with TSMC, which produces most of its chips.

Analysts in Taiwan are mixed about the impact of the deal on TSMC. Altera accounts for about three percent of TSMC's sales revenue.

George Chang, an analyst at Yonta Securities in Taipei, said that Intel ’s acquisition of Altera “may be a long-term disadvantage for TSMC. He said:“ This shows Intel's enthusiasm for entering the foundry market. "

"Altera has not announced its 10nm process, so the acquisition could affect this decision," said Randy Abrams, an analyst at Credit Suisse in Taipei. "Even though the acquisition was made, because Incompatible processes and the resources required to re-verify parts, we also want Altera to keep nodes at 20nm and above at TSMC. "

Abrams said Intel lacks equipment to support various backward nodes, so if Intel buys Altera, its financial impact on TSMC should be small.

Altera is the second largest FPGA manufacturer after Xilinx. IC Insights ranks it as the 39th largest chip maker with 2014 revenue of $ 1.9 billion, while Xilinx ranked 30th with $ 2.4 billion. Semico predicts that the entire FPGA market will grow from $ 5.4 billion this year to $ 7.4 billion in 2019, slightly higher than the industry.

Intel has experimented with the link between its server processors and FPGAs, and Microsoft has begun to adopt this approach in its data centers. However, Intel does not have to acquire Altera to obtain FPGA technology.

Wawrzyniak said a few smaller companies are licensing FPGA modules. Intel also makes FPGAs for smaller companies such as Achronix and Tabula, which will close this month.

Deutsche Bank analyst Ross Seymore said in a report late Friday: "Altera and Broadcom have long been considered Intel acquisition targets. "

"Given their foundry relationship at 14nm, Altera's need for leading technology, and Intel's expertise in process technology, we think this is as strategic today as it was in the past," Seymore said. However, Intel added: "Intel's $ 20 billion stock repurchase program announced last year seems to have reduced the likelihood of such a large-scale transaction because Intel seems to consider buying back its own stock a better option."

An analyst on Wall Street speculated that Intel may acquire an FPGA company as early as 2010.

Following the announcement of NXP's bid for Freescale Semiconductor earlier this year, the report on the acquisition of Altera is the latest news in the semiconductor industry's consolidation trend.

Maybank Kim Eng Securities analyst Warren Lau said in a report today: "The rapid integration of the chip industry and the rise of integrated equipment manufacturers could threaten the foundry business model." Lau said that given Samsung's $ 60 billion in cash Reserves, which could be the next company to acquire.